Personal Finance - Real Estate Portfolio

Personal Finance - Real Estate Portfolio

-

2 mins

A Real estate portfolio is a collection of investment assets in the real estate sector. This includes primary home, rental properties, and real estate investment trusts (REITs).

Investment in Real-Estate had made more Billionaires than any other type of investment. One of several strategies of this investment is “Leverage”. Leverage in real estate is using borrowed money to buy a property. When leveraging a property, one borrows funds from a lender to be able to purchase an investment property instead of having to cover the entire purchase price oneself. Being able to leverage one’s investment is one of the reasons real estate investing is so attractive.

One can take 3 to 4 times of leverage on the investment amount from banks or lenders.

Real estate should be part of one’s portfolio. Make Real estate around 10%-14% of the overall portfolio allocation.

One must have a Primary Home & if possible some Rental Properties.

Resources

Few simple & passive ways to invest in real estate

- Fundrise (residential properties)

- CrowdStreet (commercial properties)

- YieldStreet (few deals)

Sample growth:

-

Fundrise says its average annualized platform returns were between 7.31% and 16.11% between 2017 and the third quarter of 2021.

-

Expected Annual Rate of Return (IRR), 17.10%

-

The average net internal rate of return is 11.42%.

-

Vanguard Real Estate Index Fund ETF (VNQ or VNQI)

BOOKS Recommendations

Money – Master the Game

By TONY ROBBINS

Lessons Learned:

- Never underestimate the exponential power of compounding interest. Taxes Kill Compounding.

- Automate investing or you probably won’t do it.

- Invest 10-15% of income each month no matter if the market is up or down.

Play with this excel sheet to see the difference between simple and compound interest.

Click here to download the file simple_vs_compound_interest.xlsx

Rich Dad, Poor Dad

By Robert T. Kiyosaki

Lessons Learned:

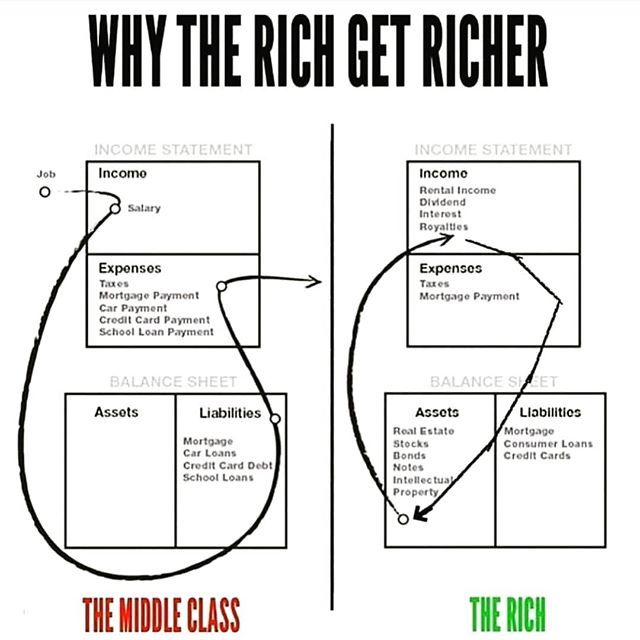

- It’s not how much money you make, it’s how much you keep.

- The poor and the middle-class work for money. The rich have money to work for them.

- The rich focus on their asset columns while everyone else focuses on their income statements.

Conclusion

Building a real estate portfolio requires careful planning and research at every stage of the process and also requires constant reflection and analysis. The more you learn, the more you earn. Your success depends on what you know, so take continuing education seriously if you want to build wealth.

DISCLAIMER: All views expressed on this site are my own and do not represent the opinions of any entity whatsoever with which I have been, am now, or will be affiliated. Any collateral used is referenced in the Web Resources or others sections on this page. The information provided on this website does not constitute investment advice, financial advice, or trading advice.